Overcoming the Fear of Spending Money

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Almost anywhere you read, listen, or view content about personal finance, it’s almost inescapably about not having enough money.

And sure, there are far more people who struggle with having or earning too little money than those who have plenty.

But…

This doesn’t mean that everyone who’s “made it” financially is living as well as they could.

Working Too Much, Spending Too Little

My wife and I were driving to Asheville, North Carolina, to meet up with her brother and his wife for a long weekend.

Along the way, to pass the many-hour drive, we talked, listened to music, and looked at the beautiful countryside.

Then, my wife put on Ramit Sethi’s podcast, “I Will Teach You to Be Rich.”

It was an episode with a couple who had over $12 million saved up. The wife had undergone a double lung transplant, giving her a life expectancy of about five years, so she wanted to spend as much time as possible with her daughters while she could.

Despite this, she kept working full-time.

She just couldn’t get herself to stop earning as much as she could so she could invest more and more.

This wasn’t the only episode with people who had “won the money game,” having accumulated a net worth far above what they needed to retire, but couldn’t stop playing, even when they weren’t enjoying it.

Or couples who had plenty saved up and were making a high income, but couldn’t bring themselves to spend what they clearly could to enjoy their lives.

Why Is Not Spending More Money a Problem?

Money can buy happiness.

And no, happiness doesn’t peak or even plateau at $75k a year income or even $500k a year. Research shows that it keeps going up and up as you make and have more and more money.

However, for this to be true, you need to have a reasonably healthy relationship with your money.

If you’re constantly in fear that you don’t have enough, no matter how much you earn and how much you’ve accumulated, you won’t experience that happiness.

Even if you bring yourself to spend more than the $55k median income in the US or even more than the $140k that’s equal to the 90th percentile of income, you’d be underspending if your net worth is high enough.

For example, say you’ve retired with a net worth of $6 million and get $40k a year from Social Security, you could safely spend (assuming a conservative 3 percent safe withdrawal rate) $220k a year.

Here’s what happens if that’s you and you spend $140k instead.

Your net worth will keep growing because you’re essentially “investing” the $80k a year difference. At some point, you die, likely leaving an unimaginably large estate.

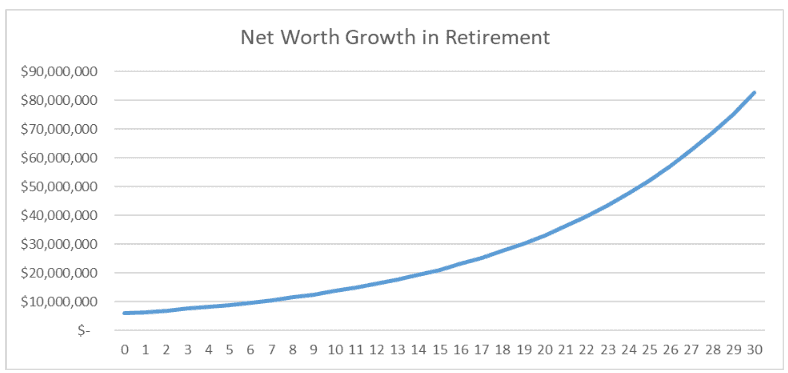

Here’s what it might look like if your investment returns 10 percent a year.

If your retirement lasts 30 years, your net worth would grow from the initial $6 million to over $82 million!!!

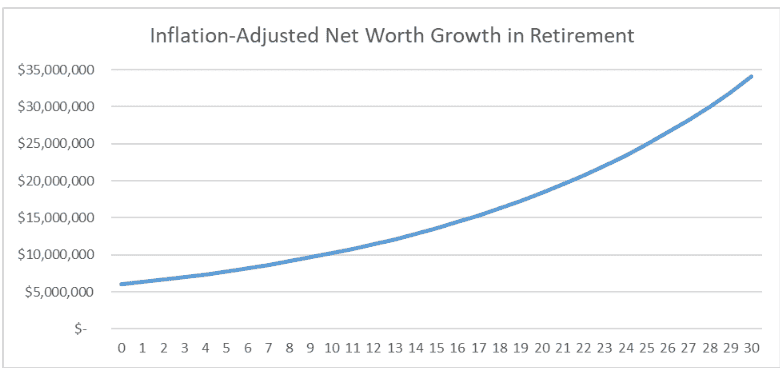

“Wait a minute!” you might be thinking, “What about inflation?”

Fair enough. Let’s apply a 3 percent annual inflation to your spending, the dollars in your investments, and your Social Security benefits. Here’s what that would look like.

In 30 years, your initial $6 million would grow to “only” $34 million in today’s dollars.

That still qualifies as Ultra-High Net Worth (UHNW).

Know what’s the problem with this scenario?

It’s that you’ve lived a far smaller life than you could have, and as Sethi says, that’s a tragedy.

Even if you can have everything you want without spending as much as you can, you could have gifted more to your kids and grandkids while you were still around to enjoy seeing the positive impact that would have had on their lives.

Or, if you don’t have kids and grandkids, you could have donated generously to your congregation, your favorite charity, and your favorite institution (e.g., museums, public libraries, memorials such as George Washington’s Mt. Vernon, etc.).

How Can You Fix Your Fear of Spending Money?

Since the problem isn’t one of money, but rather one of your emotions, a good therapist, especially a therapist who specializes in financially related issues can help.

Alternatively (or in addition), you could hire a financial planner to help you craft a comprehensive financial plan. One that’s based on your values, goals, and dreams. One that informs how much and in what to invest, and more importantly, how much and on what to spend.

Having a professional tell you that, truly, you can afford that $50k luxe vacation of a lifetime; or donating $100k to a cause that’s near and dear to your heart; or annually gifting the allowed $36k (from you and your spouse) to each of your children, their spouses, and their children; or all of the above, can be all the “permission” you need to feel like you aren’t being impulsive and reckless with your money.

And if none of the above works for you, maybe just work out how much you can safely spend in retirement using a good retirement income calculator, how much you need to cover your non-discretionary expenses, and as a result, how much more you can spend on stuff that you don’t have to, but that’s meaningful for you.

In short, maybe all you need is a convincing budget that pushes you to spend more on things that you enjoy, as long as you don’t go beyond what your net worth allows.

Financial Pros Weigh In

To see if this is a common issue, I asked financial advisors to share their experiences with clients who struggle with underspending.

David Nash, CFP®, founder of Tend Wealth says, “It’s a surprisingly common problem. We spend our whole lives earning money and setting some aside for the future. When that future comes in retirement, it’s a huge adjustment to start spending down that pile of money.

“The first step, as an advisor, is to have a conversation to understand why the client isn’t comfortable spending and enjoying the money they worked so hard for. A financial advisor can help by calculating how much is safe to spend using sophisticated modeling software. Those projections can go beyond the typical guidance of retirement spending and include travel plans, paying for loved ones’ college expenses, charitable giving, family legacies, or other goals.

“Sometimes seeing the numbers can help provide enough comfort to get the couple or individual to start enjoying their retirement more. If spending from a pile of money and seeing the amount in the account go down is causing stress, it is also possible to structure the money to provide a guaranteed monthly income, similar to a pension. It’s not necessary for every retiree, but it can be a perfect solution for someone who wants to go back to spending based on a ‘paycheck’ with a set amount of money coming into their checking account each month.”

Arielle Tucker, founder of Connected Financial Planning shares, “I’ve worked with clients who are extremely frugal despite having sufficient resources to support a more comfortable lifestyle. In these cases, I often say, ‘You’ve worked hard to build your wealth, and it’s important that you enjoy the fruits of your labor. Let’s find a balance where you feel financially secure while also allowing yourself to enjoy life more fully.’ I encourage them to identify activities or experiences they’ve always wanted to pursue and incorporate those into their financial plan.

“I’ve also worked with clients who are intentionally choosing to be more frugal now to gain greater flexibility in the future. My role here is to help them stay on track toward their long-term goals without sacrificing their present well-being unnecessarily. It’s important that they don’t end up working extremely hard and being frugal indefinitely. Together, we strive to find the right balance between saving for the future and enjoying life today, ensuring their financial plan aligns with both their current happiness and future aspirations.

“There are several reasons why individuals might underspend: (a) Fear of running out of money – past experiences with financial hardship or a deep-seated fear of poverty can make people hesitant to spend. (b) Lifelong habits of saving and frugality can be hard to break, even when circumstances change. (c) Lack of confidence in financial planning – without a clear understanding of their financial situation, people may default to saving as a precaution. (d) Emotional attachment to wealth – money can represent security, success, or self-worth, making it difficult to part with. It’s important to recognize that money is not just a financial tool but also has emotional and psychological dimensions.

“As a financial advisor, part of my role is to help clients align their financial resources with their life goals and values. Encouraging clients to embrace a mindset of abundance rather than scarcity can lead to their living a more fulfilling life without compromising their financial security.”

The Bottom Line

Sure, far more people have problems related to spending more than they can afford than vice versa.

Still, underspending can also be a very real problem.

The above shows why and offers several ways to fix it.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.